Originally published August 2020; updated October 2023

Airports can be like small cities with roads, utilities, restaurants, shops, real estate development, parking, police and fire, construction, and more! So, how does this all work? Where does the funding come from? Are taxpayers footing the bill like they do for libraries and stadiums?

If you don’t use the airport, you’re not paying for the airport.

We’ll start with the basics. Although nearly all U.S. airports are owned by state or local governments, airports are required by the federal government to be as self-sustaining as possible and receive little or no taxpayer support. This means that airports must operate like businesses — funding their operations from their revenue, and thoughtfully and diligently planning funding for major improvement projects — which can often be very expensive. Airports are supported by the users of the airport and the fees, rents, or leases in place with airlines, tenants, and travelers. The bottom line for local taxpayers is “if you don’t use the airport, you’re not paying for the airport.”

Seattle-Tacoma International Airport (SEA) is no different. The Port of Seattle operates SEA Airport, along with the maritime facilities downtown and real estate properties in the region. The Port is what’s called a “special purpose government” that is authorized by the State of Washington to operate the airport and is responsible for the efficient financial management of the facilities for the public benefit. Because the Port is a governmental entity, there is no profit, no shareholders, and no dividends.

The Federal Aviation Administration (FAA) regulations govern public-use airports like SEA and provide grants for a portion of aviation-related improvements on things like runways. In accordance with the FAA revenue use policy, all revenues generated at the airport must be spent at the airport. Any surplus cash after the payment of annual expenses and debt obligations is reinvested at the airport.

Does SEA make a profit?

No, revenue that is generated at the airport stays at the airport and any revenue over operating costs is reinvested back into the airport to fund current facility upgrades or new projects. This is required of all U.S. airports.

How does this work?

As we mentioned before, airport operations are paid for by the users of the airport. This includes two categories, aeronautical and non-aeronautical revenues.

- Aeronautical revenues come from the use of airport facilities, primarily paid by the airlines for landing fees, as well as rent and user fees for things like the use of gates, ticket counters, office space, maintenance hangars, cargo facilities, and the use of the Customs facilities

- Non-aeronautical revenues come from terminal and landside use such as market-rate rents by dining and retail concessionaires, who pay a percentage of their revenue to the Port, the use of the airport by ground transportation (like taxis, limos, airport/hotel shuttles, and ride-share), parking fees in the garage, fees for rental car companies, and other building or ground leases for operations like flight kitchens

Who pays the most in fees?

Airlines are the biggest users of the airport, as you might expect, with landing fees plus space and facility rentals. In 2024, the Port is budgeting aeronautical and non-aeronautical revenues to make up 61% and 39% of total revenues, respectively.

How are airline fees determined and paid?

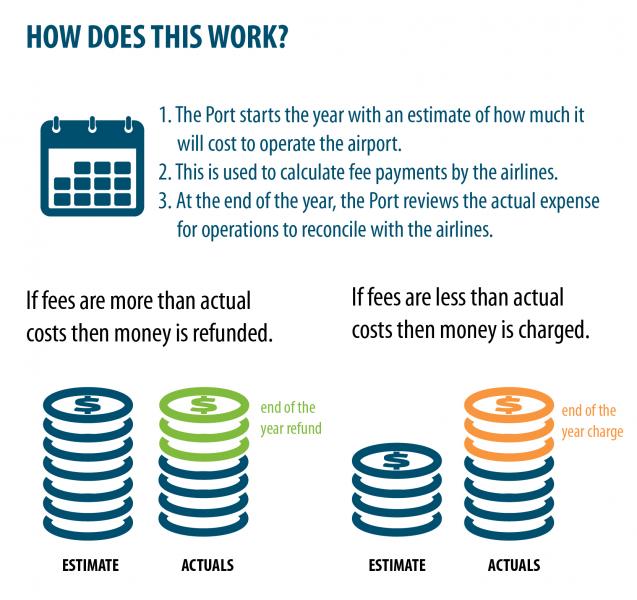

Aeronautical fees for the airlines are based on the cost of operating airport facilities they use. Here’s how this is tracked every year:

1. The Port starts the year with an estimate of how much it will cost to operate the facilities the airlines use. This is used to set rates that are billed monthly to the airlines.

2. At the end of the year, the Port reviews the actual expenses to reconcile with the airlines.

a. If their fees paid during the year were under the actual costs, the Port will charge the airlines the difference.

b. If their fees were larger than actual operations costs, the Port will refund money to the airlines.

For example, in 2022 the airlines paid about $8.3 million over budgeted costs. Typically, that is credited or billed by June of the following year.

Are there more airport funding sources?

There's always work to do at an airport, and that requires funding. Because SEA Airport has become busier every year, there are always dozens of projects going on to maintain and improve the current airport facilities. Examples include the Baggage Optimization Project, C Concourse Expansion Project, redevelopment of the North Main Terminal (SEA Gateway), and S Concourse Evolution, to name only a few.

Additional funding sources for the airport also come from Passenger Facility Charges (PFCs), bonds, and grants.

- Passenger Facility Charges (PFCs) are regulated by Congress, collected by the airlines as part of passenger ticket prices, and then returned to airports based on the airports they travel to and from. PFCs can only be used for specific approved capital projects and debt service on those approved projects such as North Satellite Modernization and International Arrivals Facility

- Federal funding comes from Airport Improvement Program (AIP) grants that are then used for specific purposes to increase capacity, safety, security, or reduce noise. Like other airport revenues, these funds are derived from excise taxes from aviation users deposited to the Airport and Airways Trust Fund and not general taxes

- Other state and local grants can also be applied

Is the Port paying for everything in cash?

In addition to grants and PFCs, SEA pays for some capital improvements with cash, but the majority of funding for the airport’s capital budget comes from revenue bonds.

How do bonds help finance the airport?

Bond repayments are part of the cost of running the airport, and the revenues generated from airline, non-airline tenants, and customers pay for the debt service of those bonds. The Port agreement with the airlines requires having enough revenue to be a minimum of 25% higher than the annual debt service. Simply, this would be the ratio of the revenues generated by the airport minus the operating expenses divided by the debt service. SEA has never had to charge the airlines extra fees to achieve this debt service coverage minimum, and current 2023 and 2024 forecasts do not expect it to happen.

Are any Port taxes used by the airport?

As mentioned above, operations are paid for by revenue generated at the airport by direction from the FAA. No Port taxes go to those payments.The only exceptions related to the airport are certain noise insulation projects that the FAA deemed to be ineligible for use of airport revenues and an annual fee paid to the city of SeaTac.

- Learn more about SEA Airport Financing and the economic impact of the airport